Making a deductible contribution can help you lower your tax Monthly bill this calendar year. Plus, your contributions will compound tax-deferred. It’s difficult to find a much better deal.

determined by your circumstance, This may enable you to place away far more in direction of retirement or other needs, Navani notes. check with your tax advisor how inflation changes have impacted your present tax image, he indicates.

one hundred% precise skilled-authorised ensure: If you pay out an IRS or condition penalty (or interest) as a result of an mistake that a TurboTax tax expert or CPA manufactured whilst delivering matter-particular tax suggestions, a section evaluation, or performing as a signed preparer on your return, we are going to fork out you the penalty and fascination. restrictions apply. See conditions of assistance for specifics.

"nearby" Pros for the goal of in-person conferences are outlined as getting Positioned in fifty miles of The customer's zip code. In-human being conferences with community Pros are offered on a restricted foundation in a few locations, but not obtainable in all States or locations. Not all professionals provide in-particular person companies.

The proportion of those expenditures that is certainly deductible is based over the square footage on the Office environment to the total location of your home.

Tax guidance, qualified assessment and TurboTax Stay: Access to tax suggestions and qualified Review (the chance to Have a very Tax qualified critique and/or indication your tax return) is included with TurboTax Are living Assisted or as an enhance from another version, and accessible by way of December 31, 2024. Intuit will assign you a tax specialist based upon availability. Tax professional and CPA availability might be limited. Some tax subject areas or predicaments may not be incorporated as aspect of this services, which shall be decided while in the tax qualified’s sole discretion. for that TurboTax Reside Assisted product, In the event your return needs a big standard of tax advice or true preparing, the tax specialist can be necessary to indication because the preparer at which stage they're going to presume primary responsibility to the preparing within your return.

you will need to be enrolled in a overall health insurance coverage plan which has superior deductibles that meet or exceed the IRS’s required amounts.

vehicle financial loans guideBest vehicle loans once and for all and terrible creditBest auto loans refinance loansBest lease buyout financial loans

quite a few Individuals don’t need to file a tax return on a yearly basis. actually, you may not really need to file a tax return unless your whole earnings exceeds certain thresholds, otherwise you meet specific filing requirements.

determining no matter if to itemize or take the typical deduction is a huge Component of tax scheduling as the alternative could make a massive variation in your tax Monthly bill.

After you’ve calculated your taxable earnings, you must start implementing relevant deductions. Should you have several bills that qualify as itemized deductions, you'll be able to increase All those together to see should you’d be much better off itemizing or simply declaring the common Deduction. Odds are, basic tax situations gain a lot more from claiming the typical Deduction.

Under new suggestions, if somebody else pays the personal loan, the IRS sights it as in the event you were given The cash and utilized it to pay for the student mortgage. should you fulfill all of the website necessities then you'd probably be suitable to the deduction.

100% precise professional-accredited ensure: If you fork out an IRS or state penalty (or curiosity) on account of an mistake that a TurboTax tax specialist or CPA made although delivering subject-unique tax advice, a piece critique, or acting for a signed preparer for your personal return, we will fork out you the penalty and desire. Limitations utilize. See Terms of Service for aspects.

The catch is, you will need to itemize as a way to deduct charitable contributions, and approximately ninety% of taxpayers assert the conventional deduction as an alternative to itemizing for the reason that it offers An even bigger tax reward.

Luke Perry Then & Now!

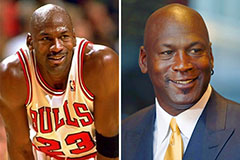

Luke Perry Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Sam Woods Then & Now!

Sam Woods Then & Now! Danielle Fishel Then & Now!

Danielle Fishel Then & Now! Jaclyn Smith Then & Now!

Jaclyn Smith Then & Now!